What Are The Backtesting Strategies When Trading Crypto?

Backtesting crypto trading strategies involves replicating the usage of a trading strategy using historical data to assess its effectiveness. These are the steps needed to backtest crypto trading strategies. Historical Data: Get historical data on the cryptocurrency asset being traded. This includes price and volume, as well as other market data.

Trading Strategy Definition of the trading strategies which are being tested.

Simulator: This program allows you to simulate the implementation of a trading strategy based on historical data. This allows you see how the strategy performed in previous years.

Metrics: Use metrics to assess the effectiveness of your strategy, for example the Sharpe ratio, profitability, drawdown, and other relevant measures.

Optimization Modify the strategy's parameters, and then run the simulation once more to optimize your strategy's performance.

Validation: Evaluate the strategy's performance with out-of–sample information to test the validity of the strategy.

It is essential to remember past performance is not an indication of future results. Backtesting results shouldn't be relied on to guarantee future profits. Also, you should consider the volatility of markets and transaction costs when applying the strategy for live trading. Check out the top rated updated blog post about automated cryptocurrency trading for blog advice including robo trading software free, ea forex robot, best crypto swap exchange, mcx auto trading software, algo trading free software, binbot pro robot, bitmax crypto, start trading crypto, all crypto exchanges, forex scalping forum, and more.

What Are The Functions Of Automated Trading Software's Cryptocurrency Trading Bots Operate?

A set of pre-defined rules are adhered to by the software for trading in cryptocurrency and the robot executes trades for the user. This is how they work trading strategy A user can define a trading strategy, including entry and exit rules as well as position sizing and the rules for managing risk.

Integration: The bot for trading integrates with the cryptocurrency exchange via APIs that allow it to access real-time market data and make trades.

Algorithms: The bot employs algorithms to analyse market data and take decisions that are based on a strategy for trading.

Execution. Without the necessity to manually alter the system the bot will execute trades according to the trading strategy's rules.

Monitoring The trading bot continually checks and adjusts itself to the market as necessary.

Automated trading using cryptocurrency can be extremely beneficial. They are able to execute complicated routine trading strategies without the need for human intervention. However, it's important to realize that automated trading has its own set of risks, which include the potential for software mistakes as well as security flaws, as well as losing control over trading choices. It is vital to carefully evaluate and test any trading bot prior to using it for live trading. Take a look at the recommended rsi divergence cheat sheet for site examples including cost to start a crypto exchange, blockfi trading, daily crypto trading, best free stock market chat rooms, daily income automated trading system, automated day trading strategies, best stock chat rooms free, ftx exchange stock, best crypto for trading, automated backtesting, and more.

What Are Automated Trading Bots? And What Software And Platforms Does It Use?

A trading robot is a computer program that was designed to execute trades for traders. It is programmed with defined rules and algorithms. The bots are programmed to analyze market data, including price charts and technical indicators and execute trades according to the guidelines and strategies set by the trader.Automated trading bots are able to operate on a variety software and platforms, depending on the programming language and platform used. Some popular programming languages for automated trading bots include Python, Java, and C++. The preferences of the trader as well as compatibility with platforms for trading will decide the software or platform selected.

Here are a few examples of software and platforms which can be used to build automated trading bots.

MetaTrader The MetaTrader platform is a popular trading platform that lets traders to develop and run automated trading bots with the MQL programming language.

TradingView This platform allows traders to create and test trading strategies with their own Pine Script programming language.

Cryptohopper is a platform that allows automated trading of cryptocurrency. The platform permits traders to develop and test back-testing bots using historic data.

Zenbot: Zenbot can be customized on any platform such as Windows, macOS or Linux.

Python-based software: A variety of Python-based applications, like PyAlgoTrade (Backtrader) and PyAlgoTrade (PyAlgoTrade), allow traders to design and manage robots for trading with the Python programming language.

The preferences and technical skills of the trader will determine the software and platform that they use. Have a look at the most popular here on cryptocurrency trading for blog tips including avatrade crypto, best automated trading software for interactive brokers, cheapest cryptocurrency on robinhood, crypto live trading, top 10 cryptocurrency trading platforms, robot for trading stocks, ibkr crypto, etoro cryptocurrency, start trading crypto, bitsgap app, and more.

Which Are The Best Platforms For Crypto Trading That Are Automated?

There are many options for automated trading in cryptocurrency. Each platform offers the features and capabilities of its own. 3Commas. 3Commas. This web-based platform allows traders to create automated trading bots for different cryptocurrency exchanges. It is able to support multiple trading strategies, including both long and short. Additionally, users are able to backtest their bots with historical data.

Cryptohopper: Cryptohopper, a cloud-based platform, lets traders build trading bots that can be executed on various exchanges. It provides a wide range of pre-built trading strategy options as well as a visual editor to create customized strategies.

HaasOnline. HaasOnline can be downloaded as a software program that allows traders as well as other users to create and run automated trading bots on numerous cryptocurrency exchanges. It comes with advanced features such as market making, backtesting, and arbitrage trading.

Gunbot: Gunbot is a program that can be downloaded and used by traders to build and run trading bots that work with a variety of currencies across several exchanges. It comes with a selection of already-designed strategies, and the ability for customized strategies to be developed by using a visual editor.

Quadency: Quadency, a cloud-based platform, allows traders to develop and operate automated trading bots using multiple cryptocurrencies across several exchanges. It has a variety of trading strategies, as well as tools to manage portfolios including backtesting, backtesting, and backtesting capabilities.

Consider factors like the number of trading and exchange strategies that are available, as in user-friendliness and cost when selecting an exchange that supports cryptocurrency. You should also test any platform for trading using demo accounts or even with very small amounts of actual funds, before you use it to trade live. Follow the top on bing for more tips including automatic option trading, ibkr automated trading, best crypto to day trade 2021, thinkorswim automated trading drag and drop, 3commas copy trading, automated crypto trading coinbase, trading auto, automate your trading strategy, metatrader 5 automated trading, deribit futures, and more.

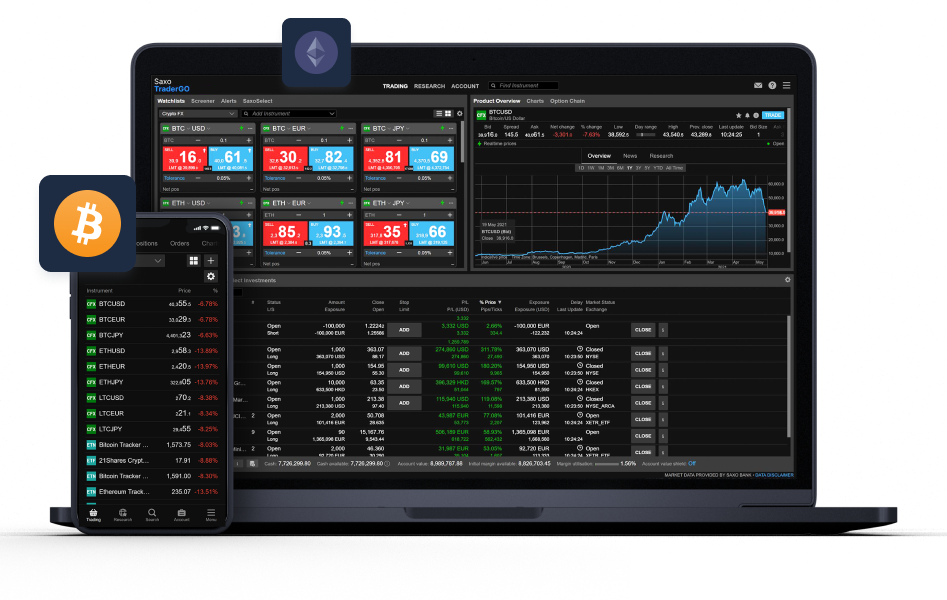

What Are The Major Differences Among Online Cryptocurrency Trading Platforms

There are a variety of differences between cryptocurrency trading platforms that are online. Security The biggest distinction between them is their level of security. While some platforms have stronger security measures, like two-factor authentication or cold storage, others might have weaker security measures, making them more susceptible to theft and hacking.

User Interface: The user interface for cryptocurrency trading platforms can be simple and easy to more complicated and difficult to navigate. While some platforms provide sophisticated tools for trading and features, others are more geared towards beginners.

Trading Fees. This is a significant distinction between cryptocurrency trading platforms. Some platforms charge higher fees to trades, while others may have lower charges in the exchange of a less trading pair, or have more sophisticated trading features.

Accepted Cryptocurrencies Although some platforms provide more trading options than other, others might only be able to accept the most well-known cryptocurrencies.

Regulation: Every platform may have different levels of oversight or regulation. Certain platforms are more tightly controlled, whereas others will operate under minimal oversight.

Customer Support: Different cryptocurrency trading platforms have various levels and types of customer care. Some platforms may offer 24/7 customer service via phone or live chat and others might provide support via email or restricted hours of operation.

Summary: There are a variety of differences between online cryptocurrency trading platforms. They differ in terms of security, user interfaces and trading fees. Supported cryptocurrencies can also be traded. Regulations are also different. Traders should carefully consider these factors when choosing the platform they trade on, as they can impact the trading experience as well as the amount of risk involved. Read the top crypto trading backtesting blog for blog tips including icmarkets forexpeacearmy, tradingview strategy automation, fto automated trading platform, exness forexpeacearmy, automated forex brokers, most secure crypto exchange, binance arbitrage, automated trading machine, free trade forum, cryptocurrency exchange app, and more.

[youtube]RDgu6d5dMGE[/youtube]

Backtesting crypto trading strategies involves replicating the usage of a trading strategy using historical data to assess its effectiveness. These are the steps needed to backtest crypto trading strategies. Historical Data: Get historical data on the cryptocurrency asset being traded. This includes price and volume, as well as other market data.

Trading Strategy Definition of the trading strategies which are being tested.

Simulator: This program allows you to simulate the implementation of a trading strategy based on historical data. This allows you see how the strategy performed in previous years.

Metrics: Use metrics to assess the effectiveness of your strategy, for example the Sharpe ratio, profitability, drawdown, and other relevant measures.

Optimization Modify the strategy's parameters, and then run the simulation once more to optimize your strategy's performance.

Validation: Evaluate the strategy's performance with out-of–sample information to test the validity of the strategy.

It is essential to remember past performance is not an indication of future results. Backtesting results shouldn't be relied on to guarantee future profits. Also, you should consider the volatility of markets and transaction costs when applying the strategy for live trading. Check out the top rated updated blog post about automated cryptocurrency trading for blog advice including robo trading software free, ea forex robot, best crypto swap exchange, mcx auto trading software, algo trading free software, binbot pro robot, bitmax crypto, start trading crypto, all crypto exchanges, forex scalping forum, and more.

What Are The Functions Of Automated Trading Software's Cryptocurrency Trading Bots Operate?

A set of pre-defined rules are adhered to by the software for trading in cryptocurrency and the robot executes trades for the user. This is how they work trading strategy A user can define a trading strategy, including entry and exit rules as well as position sizing and the rules for managing risk.

Integration: The bot for trading integrates with the cryptocurrency exchange via APIs that allow it to access real-time market data and make trades.

Algorithms: The bot employs algorithms to analyse market data and take decisions that are based on a strategy for trading.

Execution. Without the necessity to manually alter the system the bot will execute trades according to the trading strategy's rules.

Monitoring The trading bot continually checks and adjusts itself to the market as necessary.

Automated trading using cryptocurrency can be extremely beneficial. They are able to execute complicated routine trading strategies without the need for human intervention. However, it's important to realize that automated trading has its own set of risks, which include the potential for software mistakes as well as security flaws, as well as losing control over trading choices. It is vital to carefully evaluate and test any trading bot prior to using it for live trading. Take a look at the recommended rsi divergence cheat sheet for site examples including cost to start a crypto exchange, blockfi trading, daily crypto trading, best free stock market chat rooms, daily income automated trading system, automated day trading strategies, best stock chat rooms free, ftx exchange stock, best crypto for trading, automated backtesting, and more.

What Are Automated Trading Bots? And What Software And Platforms Does It Use?

A trading robot is a computer program that was designed to execute trades for traders. It is programmed with defined rules and algorithms. The bots are programmed to analyze market data, including price charts and technical indicators and execute trades according to the guidelines and strategies set by the trader.Automated trading bots are able to operate on a variety software and platforms, depending on the programming language and platform used. Some popular programming languages for automated trading bots include Python, Java, and C++. The preferences of the trader as well as compatibility with platforms for trading will decide the software or platform selected.

Here are a few examples of software and platforms which can be used to build automated trading bots.

MetaTrader The MetaTrader platform is a popular trading platform that lets traders to develop and run automated trading bots with the MQL programming language.

TradingView This platform allows traders to create and test trading strategies with their own Pine Script programming language.

Cryptohopper is a platform that allows automated trading of cryptocurrency. The platform permits traders to develop and test back-testing bots using historic data.

Zenbot: Zenbot can be customized on any platform such as Windows, macOS or Linux.

Python-based software: A variety of Python-based applications, like PyAlgoTrade (Backtrader) and PyAlgoTrade (PyAlgoTrade), allow traders to design and manage robots for trading with the Python programming language.

The preferences and technical skills of the trader will determine the software and platform that they use. Have a look at the most popular here on cryptocurrency trading for blog tips including avatrade crypto, best automated trading software for interactive brokers, cheapest cryptocurrency on robinhood, crypto live trading, top 10 cryptocurrency trading platforms, robot for trading stocks, ibkr crypto, etoro cryptocurrency, start trading crypto, bitsgap app, and more.

Which Are The Best Platforms For Crypto Trading That Are Automated?

There are many options for automated trading in cryptocurrency. Each platform offers the features and capabilities of its own. 3Commas. 3Commas. This web-based platform allows traders to create automated trading bots for different cryptocurrency exchanges. It is able to support multiple trading strategies, including both long and short. Additionally, users are able to backtest their bots with historical data.

Cryptohopper: Cryptohopper, a cloud-based platform, lets traders build trading bots that can be executed on various exchanges. It provides a wide range of pre-built trading strategy options as well as a visual editor to create customized strategies.

HaasOnline. HaasOnline can be downloaded as a software program that allows traders as well as other users to create and run automated trading bots on numerous cryptocurrency exchanges. It comes with advanced features such as market making, backtesting, and arbitrage trading.

Gunbot: Gunbot is a program that can be downloaded and used by traders to build and run trading bots that work with a variety of currencies across several exchanges. It comes with a selection of already-designed strategies, and the ability for customized strategies to be developed by using a visual editor.

Quadency: Quadency, a cloud-based platform, allows traders to develop and operate automated trading bots using multiple cryptocurrencies across several exchanges. It has a variety of trading strategies, as well as tools to manage portfolios including backtesting, backtesting, and backtesting capabilities.

Consider factors like the number of trading and exchange strategies that are available, as in user-friendliness and cost when selecting an exchange that supports cryptocurrency. You should also test any platform for trading using demo accounts or even with very small amounts of actual funds, before you use it to trade live. Follow the top on bing for more tips including automatic option trading, ibkr automated trading, best crypto to day trade 2021, thinkorswim automated trading drag and drop, 3commas copy trading, automated crypto trading coinbase, trading auto, automate your trading strategy, metatrader 5 automated trading, deribit futures, and more.

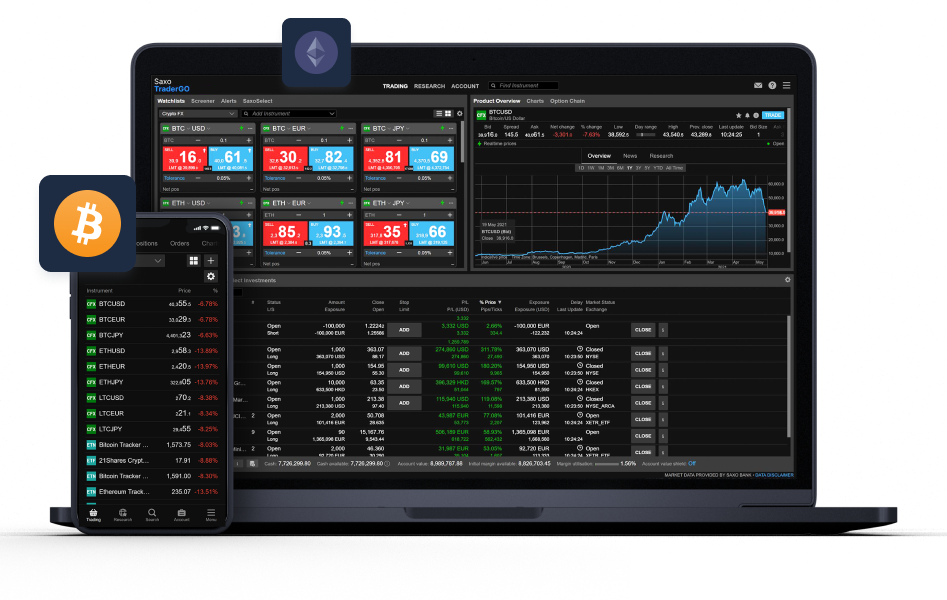

What Are The Major Differences Among Online Cryptocurrency Trading Platforms

There are a variety of differences between cryptocurrency trading platforms that are online. Security The biggest distinction between them is their level of security. While some platforms have stronger security measures, like two-factor authentication or cold storage, others might have weaker security measures, making them more susceptible to theft and hacking.

User Interface: The user interface for cryptocurrency trading platforms can be simple and easy to more complicated and difficult to navigate. While some platforms provide sophisticated tools for trading and features, others are more geared towards beginners.

Trading Fees. This is a significant distinction between cryptocurrency trading platforms. Some platforms charge higher fees to trades, while others may have lower charges in the exchange of a less trading pair, or have more sophisticated trading features.

Accepted Cryptocurrencies Although some platforms provide more trading options than other, others might only be able to accept the most well-known cryptocurrencies.

Regulation: Every platform may have different levels of oversight or regulation. Certain platforms are more tightly controlled, whereas others will operate under minimal oversight.

Customer Support: Different cryptocurrency trading platforms have various levels and types of customer care. Some platforms may offer 24/7 customer service via phone or live chat and others might provide support via email or restricted hours of operation.

Summary: There are a variety of differences between online cryptocurrency trading platforms. They differ in terms of security, user interfaces and trading fees. Supported cryptocurrencies can also be traded. Regulations are also different. Traders should carefully consider these factors when choosing the platform they trade on, as they can impact the trading experience as well as the amount of risk involved. Read the top crypto trading backtesting blog for blog tips including icmarkets forexpeacearmy, tradingview strategy automation, fto automated trading platform, exness forexpeacearmy, automated forex brokers, most secure crypto exchange, binance arbitrage, automated trading machine, free trade forum, cryptocurrency exchange app, and more.

[youtube]RDgu6d5dMGE[/youtube]